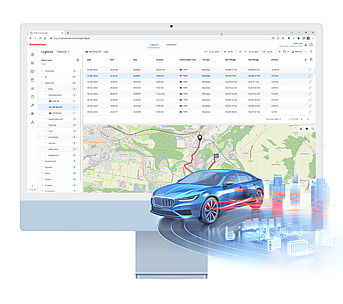

The logbook that writes itself

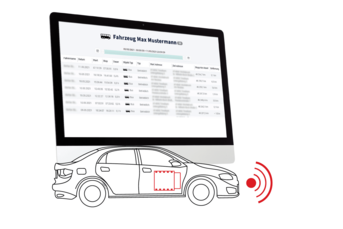

Keeping a logbook not only takes time, but also requires consistent tracking. Especially when drivers are working under time pressure, the exact recording of journeys is often neglected. But this is a thing of the past. This solution is not only practical, it is also 100% tax office compliant. What about private journeys? Only the driver knows!

Save up to 28% on administration costs with the digital logbook from Rosenberger Telematics.

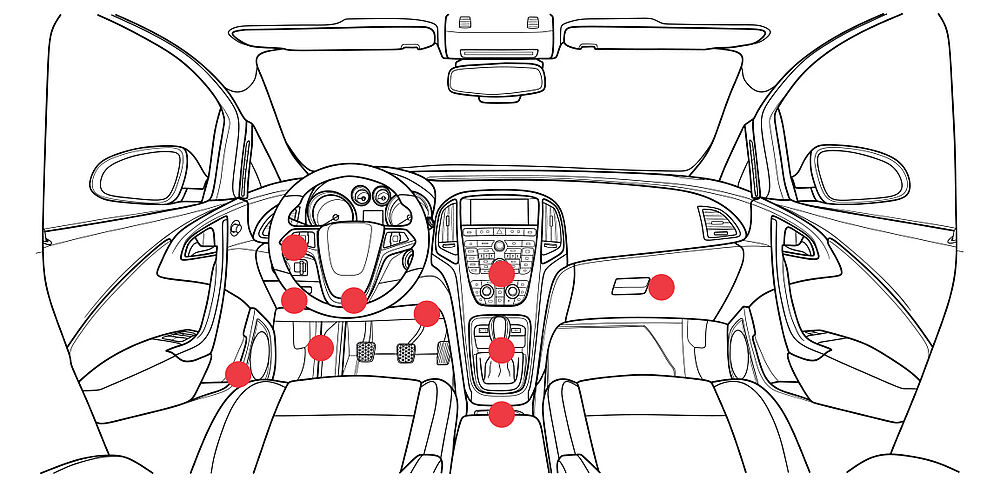

- No manual notes: your journeys are recorded automatically

- No tedious re-entry of customer visits thanks to intuitive logging

- Automatic customer allocation according to recorded customer locations (zones)

- Real-time GPS tracking of your vehicles